Seed Phrase in Cryptocurrency: The Key to Your Wallet and Assets

Losing a seed phrase means losing money. We’ve collected real cases, common storage mistakes, and tips on how to keep your seed phrase safe.

2025-09-22

Authorization is required only to use the service «Team energy»

Enter the e-mail you provided during registration and we will send you instructions on how to reset your password.

An error occurred while processing your request. Please try again later. If the problem persists, please contact our support team.

What are crypto custodians and why are they called “banks of custody”? We explain their role in seed phrase protection, HSM and MPC tech, and the leaders of 2025.

In the digital vortex of the crypto market, billions of dollars are swirling. Naturally, these assets must be securely protected. On the blockchain, custodians act as trusted guardians, shielding assets from risks. They are specialized services that blend technology and regulatory standards to secure private keys and make them resilient to threats.

Today, the top crypto custodian market has swelled to tens of billions of dollars (growing 30% annually, per Deloitte), servicing funds like BlackRock and exchanges like Binance. But who are they, and why is their role in protecting a seed phrase from being compromised so vital? This article breaks it down.

A custodian is a licensed financial institution that specializes in storing crypto assets for third parties, from BTC and ETH to NFTs.

Think of it as a "crypto-guardian bank" that shoulders the heavy burden of securely managing a seed phrase, freeing clients from technical worries. Unlike a personal wallet where the seed phrase is your responsibility, here the keys are integrated into a corporate ecosystem with multi-layered protection.

The role of custodians extends beyond a simple safe: they ensure compliance with international standards like SEC, SOC 2, and AML, insure assets (up to $1 billion), and manage risk. Their clients are institutional: banks like JPMorgan, funds, and exchanges. For retail users, services are rare and costly (0.1–2% of assets annually) but are accessible through partnerships.

In 2025, custodians are processing trillions in transactions and making offline seed phrase storage the industry gold standard.

Custodians are a symbiosis of technology and service. Their primary tasks include:

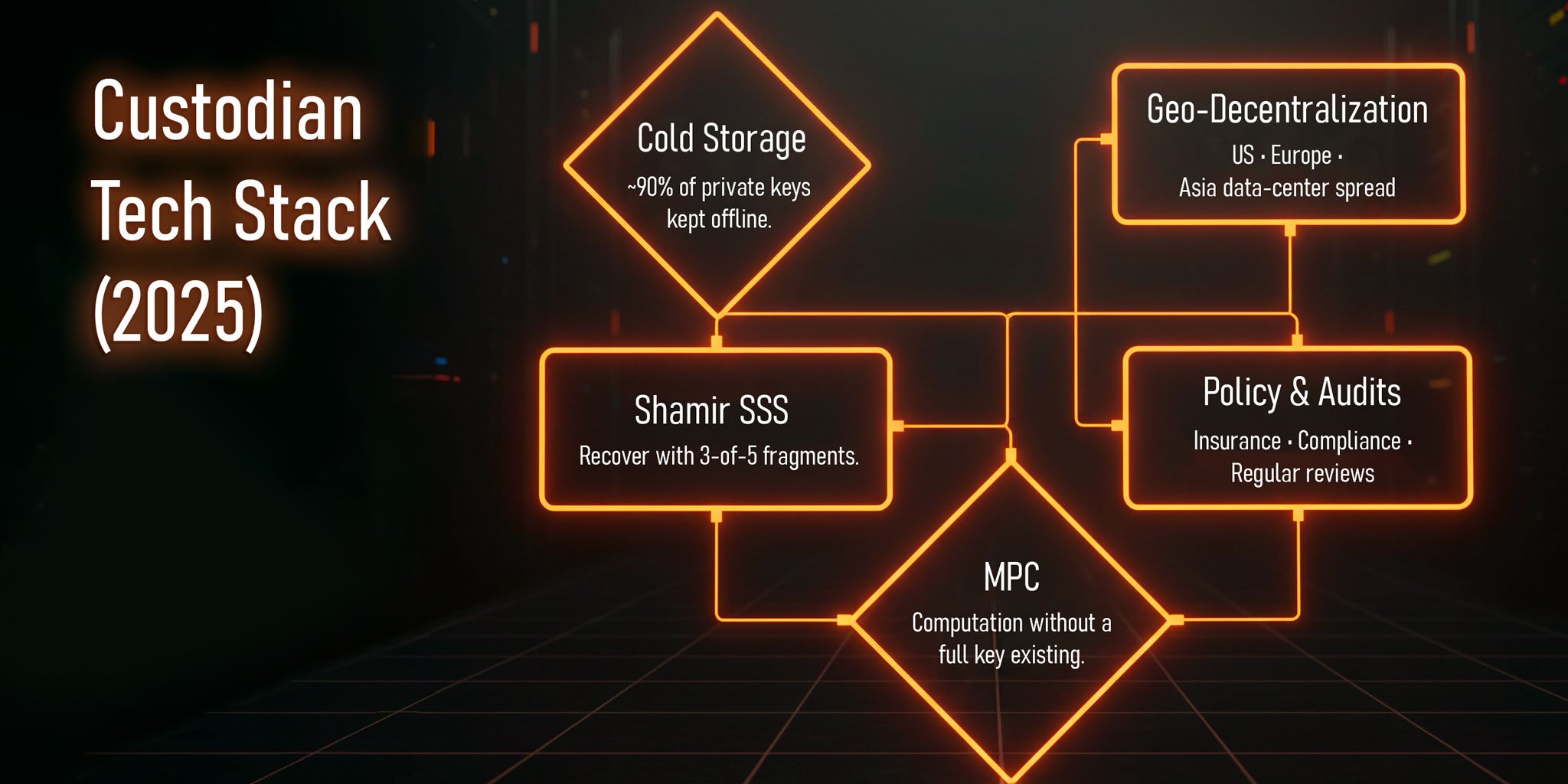

Custodians use advanced methods to protect assets, thereby reducing compromise risks. Their approaches involve offline storage, cryptographic innovations, and geographic distribution.

Below are the technologies that ensure custodians' reliability and resilience, even against sophisticated attacks:

This is why custodians lead the industry in protecting their passwords, assets, and overall secure crypto key management.

Today's leading crypto market custodians are setting the standards for security and efficiency by merging advanced tech with regulatory compliance. Their solutions, proven by billions in assets and transactions, give traders and institutions confidence in their capital's protection:

Unlike a standard personal wallet where you HODL your own seed phrase, a custodian offers a distributed system where trust is backed by licenses and audits.

| Aspect | Regular User | Institutional Custodian |

|---|---|---|

| Key Control | Full, with risks | Distributed, with audits |

| Responsibility | Personal | Professional + insurance |

| Access | Instant | On-demand via API |

| Backup | Manual | Global, decentralized |

| Cost | Minimal | 0.1–2% of assets |

| Technology | Paper/metal | HSM, MPC, Shamir |

Custodians teach us that the best seed phrase storage methods are multi-layered. Retail traders can borrow techniques like Shamir's scheme for fragmentation or cold storage for offline safety.

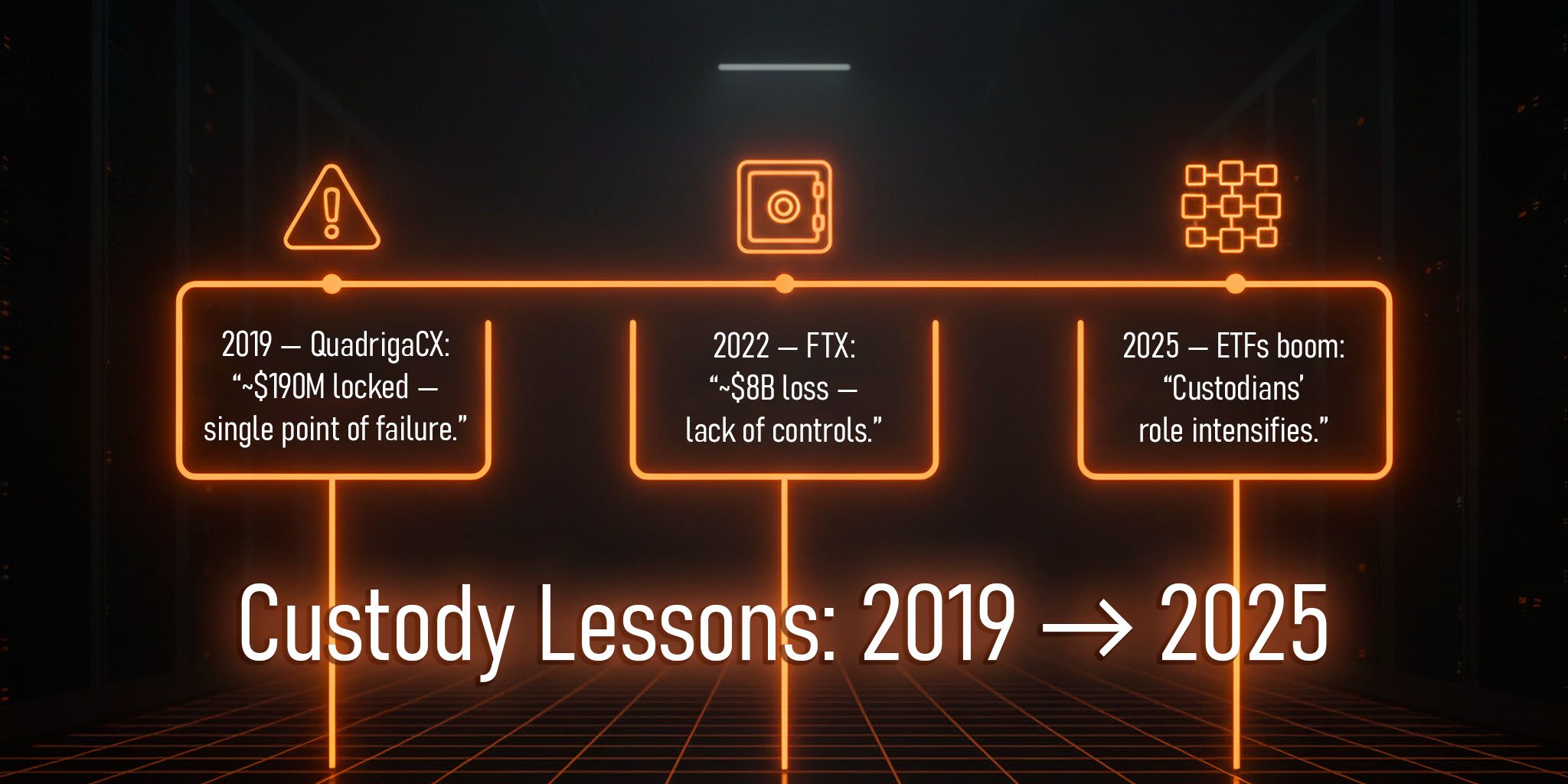

Recall FTX (2022): a lack of controls cost them $8 billion. Or QuadrigaCX (2019): the owner's death locked up $190 million due to a single point of failure. Custodians avoid this through secure seed phrase management.

Ultimately, custodians are driving the evolution of crypto storage. They successfully merge technology and regulation. In 2025, with the growth of ETFs, their role will only intensify, making crypto security accessible to all.