Why TRX Price Is Rising and USDT TRC-20 Transfers Are Getting Expensive in 2025

TRX growth in 2025 made USDT TRC-20 transfers more costly. This article explains the key events and how users can lower their fees.

2025-08-22

Authorization is required only to use the service «Team energy»

Enter the e-mail you provided during registration and we will send you instructions on how to reset your password.

An error occurred while processing your request. Please try again later. If the problem persists, please contact our support team.

Three services that give traders an insider’s edge: Lookonchain, Whale Alert, and TRON Pool Energy. Whale tracking, market monitoring, and fee savings.

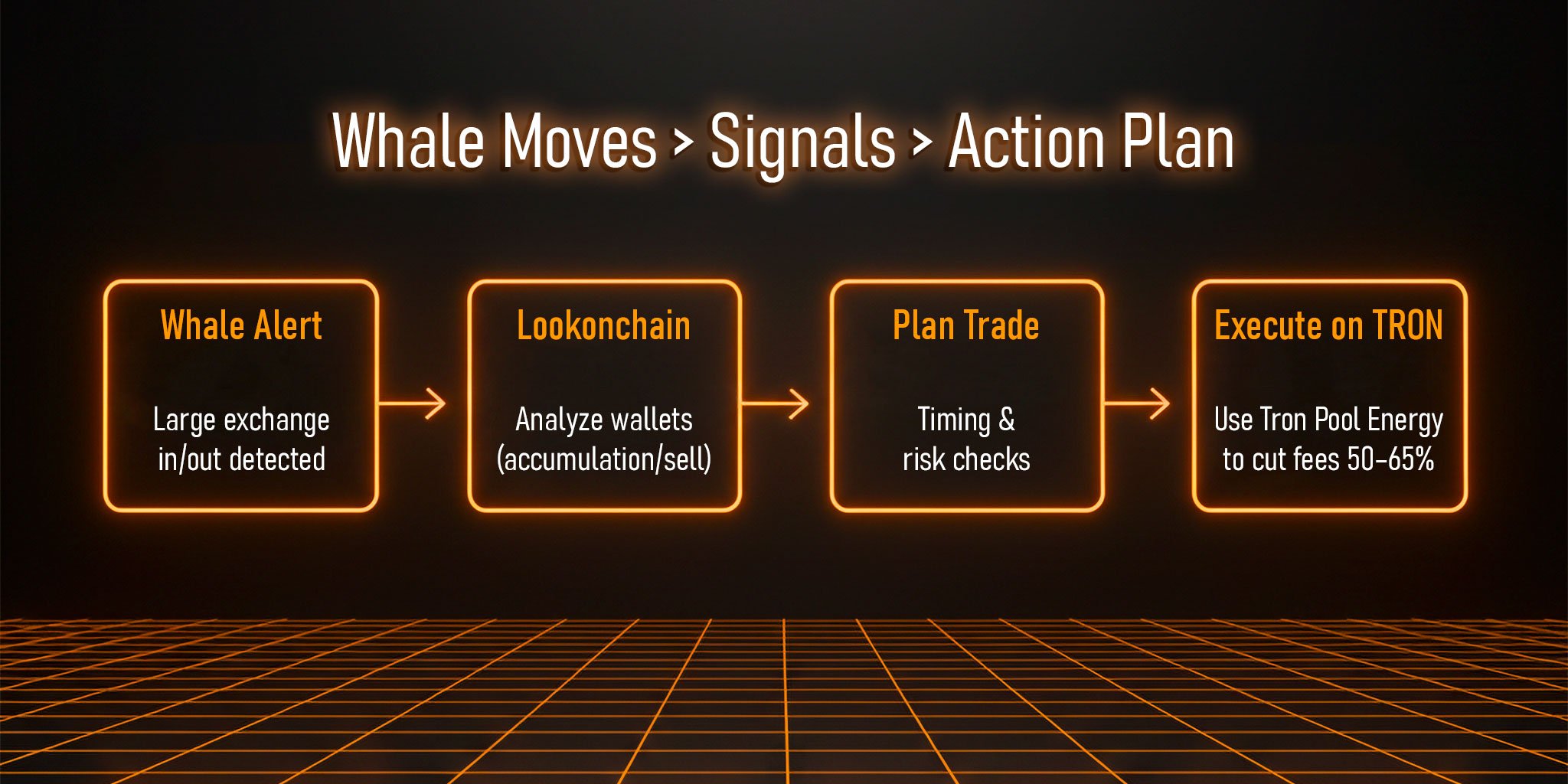

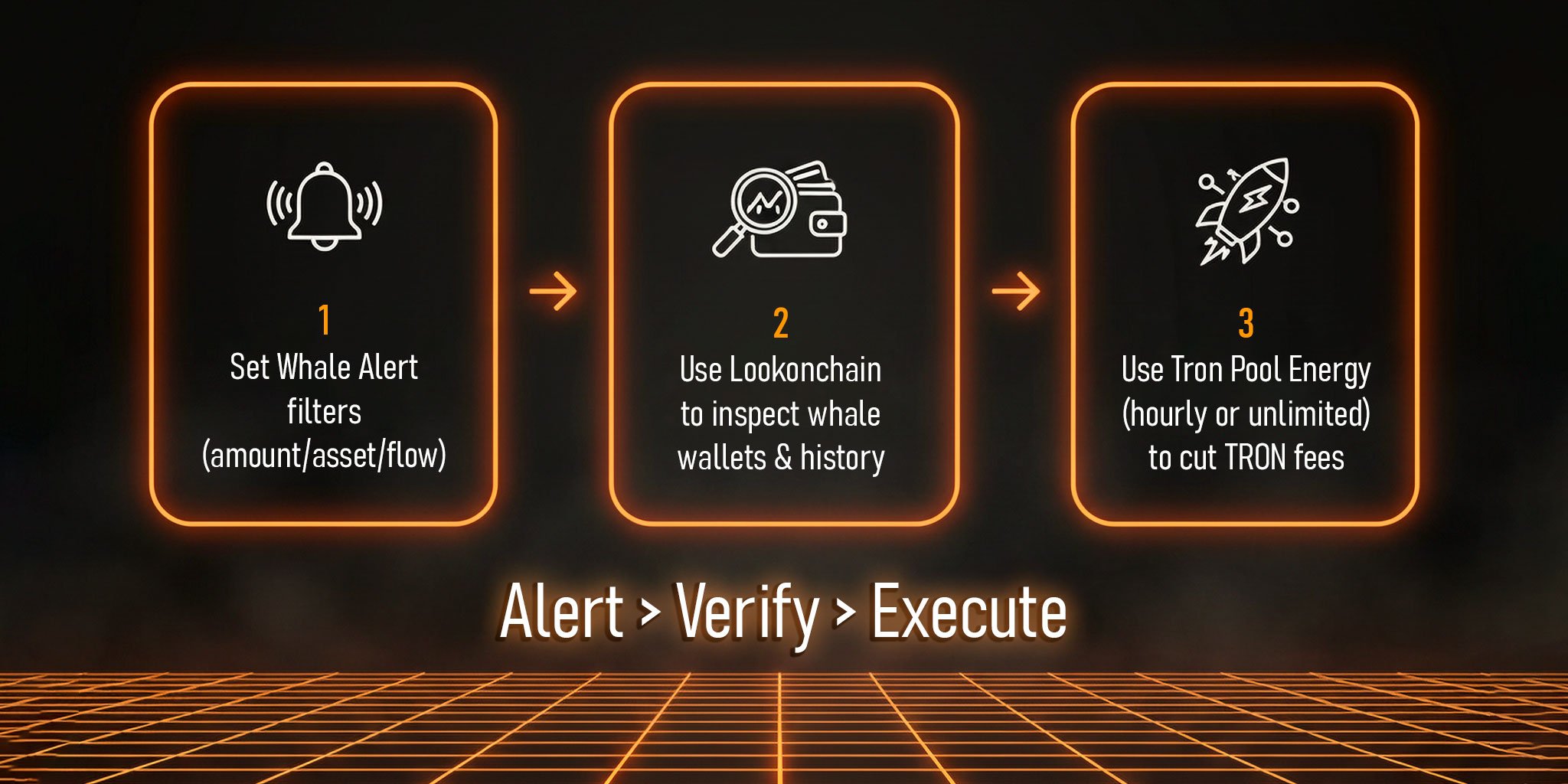

The cryptocurrency market is dynamic and often unpredictable. Technical analysis and news help, but they don’t always provide insight into how major players act. And it is precisely their moves that most often define short-term trends and influence token prices. That’s why professionals use crypto trading tools that allow them to track real transactions and optimize costs. In this article — an overview of three services that help you act like an insider: Lookonchain, Whale Alert, and Tron Pool Energy.

Purpose

Lookonchain is one of the popular cryptocurrency analytics services that aggregates data on the actions of large wallets. The service shows which projects are supported by funds and high-income traders and records their transactions. This allows you to understand how major players behave in the market and use that information when building your own strategy.

How to use Lookonchain

The interface is simple: choose the network you’re interested in and set filters by transaction volume and time. There is a Top Traders section that gathers wallets with the best profitability history. For convenience, you can enable notifications or view crypto wallet analytics online. The service is available in a free version, while a subscription unlocks access to more detailed data.

Why it’s useful for traders

Lookonchain helps you spot the accumulation of lesser-known tokens or preparations for selling in time. This reduces the risk of entering a deal too late and gives you the ability to capture growth signals at an early stage. Essentially, it’s a tool for identifying insider patterns available in public blockchain data.

Purpose

What is Whale Alert? It’s a service for tracking large cryptocurrency transactions in real time. It records transfers worth millions of dollars and alerts traders. Often, such moves signal preparations for price growth or decline.

How to use Whale Alert

You can track movements across key networks: Bitcoin, Ethereum, TRON, BSC. The user sets filters — minimum transaction amount, type of movement (wallet-to-exchange or exchange-to-wallet), and asset. In the free version, you get real-time notifications, while Premium provides advanced filters and historical statistics.

Why it’s useful for traders

Tracking whales through Whale Alert helps predict short-term market fluctuations. If hundreds of millions of USDT are moved to exchanges, it’s often a signal of a potential sell-off. Conversely, if funds are withdrawn from exchanges, growth may be expected. For traders, it’s a valuable timing tool that helps avoid unexpected dumps and use volatility to their advantage.

Purpose

While the first two tools help analyze the market, Tron Pool Energy solves a practical issue — how not to lose profit on fees. Today, TRON network fees for USDT TRC20 transfers can reach 6,77–13,37 TRX per transaction. For active traders and companies, that’s hundreds of dollars per month. The TRON Energy rental service reduces expenses by 50–65%, making each transaction more cost-efficient.

How to use Tron Pool Energy

Connection takes less than a minute: simply enter your wallet address. Resources (Energy and Bandwidth) are activated automatically and visible on the blockchain. You can choose hourly rental for one-off operations or an unlimited package for regular activity. Connection is available via the website or Telegram bot — fast, secure, and without complex settings.

Why it’s useful for traders

Tron Pool Energy cuts transaction costs on the TRON network almost in half. This means that traders save not only TRX but also retain more USDT for circulation. The effect is especially noticeable:

This solution allows you to plan your budget in advance and increases the profitability of any trading strategy.

These tools for crypto market analysis and cost optimization work in synergy. Lookonchain shows which assets major players are buying and selling. Whale Alert signals sudden fund movements between wallets and exchanges. Tron Pool Energy helps execute trading strategies on the TRON network with minimal fee expenses. Together, they form a system that allows you to view the market like an insider: to see real whale activity and not lose profit on costs.

Modern traders rely less and less only on charts and indicators. Competitive advantage comes from top trader services that help analyze blockchain data and reduce costs. Lookonchain and Whale Alert reveal what whales are doing in crypto, while Tron Pool Energy helps preserve profit by saving on USDT TRC20 fees.

By using these tools together, a trader gains both informational and financial advantages that bring them closer to the level of professionals.