TRON Fee Reduction 2025: What's Changed After Proposal #104

Proposal #104 halved TRON fees in 2025. This article explains the new USDT TRC-20 rates and how users can save even more on transfers.

2025-09-01

Authorization is required only to use the service «Team energy»

Enter the e-mail you provided during registration and we will send you instructions on how to reset your password.

An error occurred while processing your request. Please try again later. If the problem persists, please contact our support team.

How the Tether System Works: USDT Issuance, Reserves, Multichain Model and Why 70% Is on TRON

USDT remains the largest stablecoin with a market capitalization exceeding 100 billion dollars. Every day users make millions of transfers, and most of them are processed on the TRON network. However, many still don’t know how USDT is issued, what ensures its stability, and why TRON became the primary network for working with the stablecoin.

The article examines the key elements of the Tether system:

This material helps clarify how the Tether mechanism works under the hood — from issuance and reserves to the practical use of USDT within the TRON ecosystem.

The history of Tether began in 2014, when the project was launched on the Omni Layer platform on top of the Bitcoin network. This was the first step toward bridging traditional currencies and blockchain technology. A few years later, an ERC-20 version appeared on Ethereum, and in 2020 the TRC-20 standard arrived on TRON. This format made transfers faster and more stable, with fees that were predictable for users.

Over time, Tether became an industry standard. Simple conversion to dollars and integration with centralized exchanges, wallets, and DeFi platforms turned it into a universal tool for settlement and liquidity storage. Thanks to high transaction speed and reliable infrastructure, USDT gained recognition among traders and companies worldwide.

Gradually, primary USDT issuance moved to the TRON network. The decisive factors were the blockchain’s high throughput, the network’s stable operation, and support from leading exchanges. Here transfers are confirmed almost instantly, and TRON has become the main venue where USDT is actively used for payments and trading.

The issuer of the USDT stablecoin is Tether Limited, which is part of the iFinex group (together with Bitfinex). It is responsible for issuing and circulating USDT tokens across various blockchains — TRON, Ethereum, BNB Chain, Solana, and others.

The issuance process looks as follows:

Each USDT token is backed by an equivalent value of assets from Tether’s reserves — primarily U.S. Treasury bills, short-term deposits, and other liquid instruments. Information about reserves is published quarterly in Tether Transparency Reports, available on the company’s official website.

Each USDT token has backing confirmed by assets held in the company’s reserves. These data are regularly reviewed by independent auditors at BDO Italia, and the results are available publicly. The checks ensure that the volume of assets always exceeds the number of tokens in circulation.

According to the BDO Assurance Report on Tether’s reserves for 2025, the asset structure is as follows:

Reserves are updated quarterly and confirmed by an independent Tether BDO audit. The company distinguishes between fiat backing, represented by real-world assets, and digital circulation, where tokens move between wallets on the blockchain. This system makes reporting transparent, while USDT remains a reliable instrument within the Tether ecosystem.

Tether maintains openness in its operations and regularly publishes data about reserves and fund movements. You can verify them on the Tether Transparency Report page, which shows how USDT issuance works, how USDT is burned, and what the company’s assets consist of. This reporting format increases user trust and confirms that USDT’s backing is indeed supported by real assets.

Any user can check Tether’s proof of reserves and verify the authenticity of operations. To do this, simply open the Tether Treasury address on TronScan or Etherscan and review mint and burn transactions. The company does not publish proof of liabilities to protect client data, but it provides a complete picture of reserves. This makes the system safe and clear for all market participants.

Tether is developing a multichain model so that users can utilize a single asset across multiple networks. USDT issuance covers TRON, Ethereum, BNB Chain, Solana, Avalanche, and other ecosystems. All token versions represent the same asset, which can move between blockchains while preserving value and functionality.

Each network addresses specific needs and offers different advantages to users:

As of 2025, about 70% of all USDT tokens circulate on the TRON USDT network, where issuance exceeds 70 billion coins. The TRON network has become the core of the TRON DeFi ecosystem thanks to resilient infrastructure, exchange compatibility, and stable transaction processing even during high network activity.

The TRON USDT network operates on a simple system in which Energy and Bandwidth resources are used to process transactions. They determine the amount of computation and data required for a transfer, so transactions are processed reliably and without delays. Energy is consumed when smart contracts are executed, while Bandwidth is required for every operation. If a wallet has sufficient resources, transfers go through without additional charges. If resources are insufficient, the network uses a certain amount of TRX to complete the transfer.

This model makes TRON’s resource usage and fees clear and predictable. As a result, the network has become a key element of the TRON DeFi ecosystem, providing equal conditions for all users. For stablecoins this is especially important, as stable transfer costs reinforce trust and convenience in everyday payments.

The TRON network has become the primary environment where USDT TRC-20 circulates. Payments, P2P deals, and operations in DeFi applications all take place here. Each transaction uses Energy and Bandwidth. If the sender’s wallet lacks them, the system deducts a fixed amount of TRX to cover the fee.

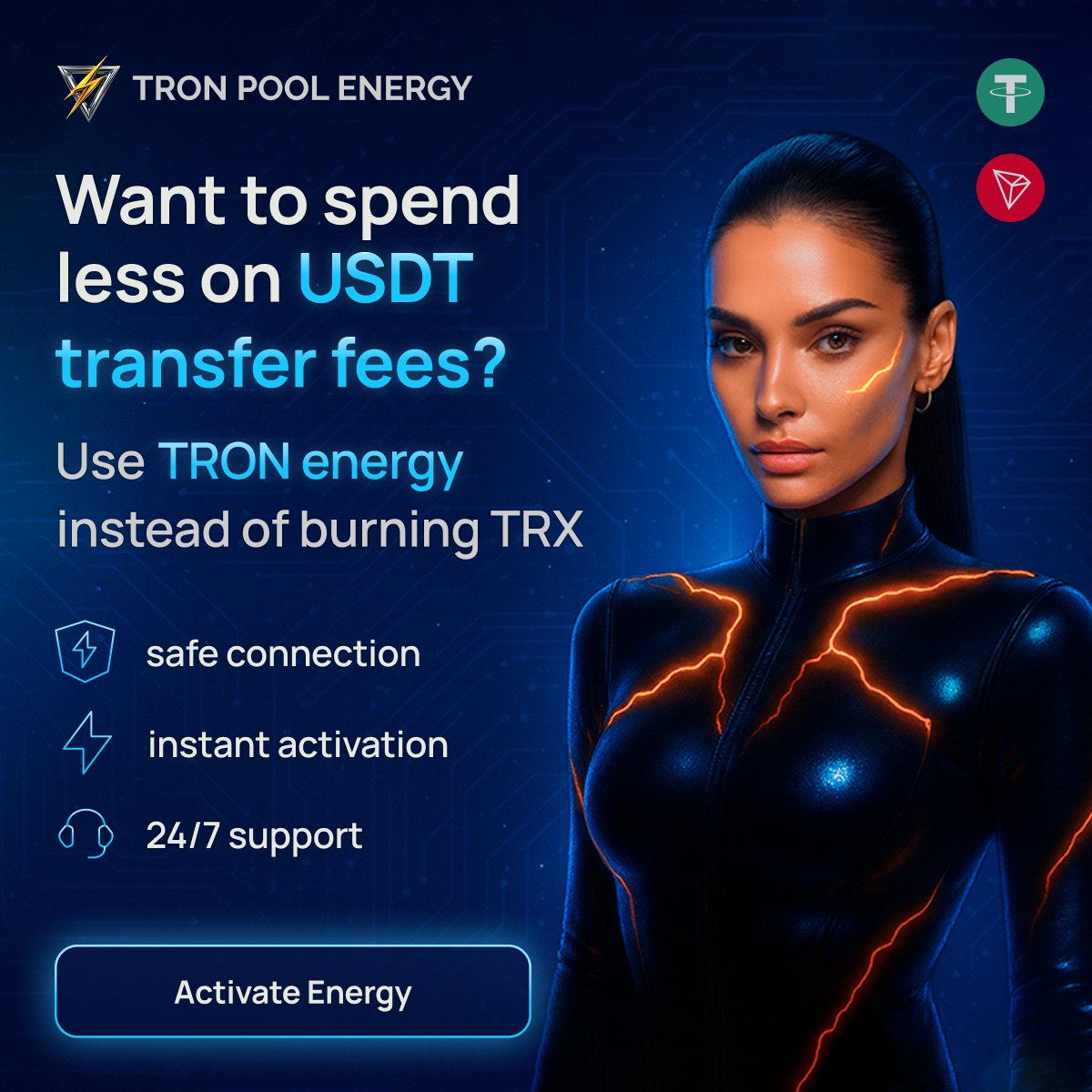

Within the TRON ecosystem there are services such as Tron Pool Energy. They help users reduce fee expenses, provision network resources — Tron energy — and make transfers without purchasing TRX.

Advantages of Tron Pool Energy

| Connection type | Average transfer fee | Best for |

|---|---|---|

| No energy rental | 6.77 TRX – 13.37 TRX | standard transaction |

| TRON energy rental for 1 hour | 3 TRX – 6 TRX | one-off operations |

| Unlimited Tron energy | depends on transfer volume; the more you send, the cheaper it gets | frequent transfers |

For businesses, the Energokassa service has been implemented. It allows topping up the balance once and distributing energy across different wallets, simplifying resource management and reducing the risk of errors.

This solution makes the TRON ecosystem flexible and cost-efficient. Tether ensures token stability, while Tron Pool Energy reduces the transfer cost of this stablecoin and makes using USDT TRC-20 as profitable and safe as possible.

Since USDT’s inception, common misconceptions have persisted around the token. Some users still doubt its backing and the transparency of its reporting. Below are the most frequent myths about USDT and the actual facts.

Myth 1. USDT isn’t backed.

This is incorrect. All minted tokens are backed by real assets, confirmed by regular checks and Tether’s proof of reserves. The company publishes reports on its website indicating how reserves are formed and where they are held.

Myth 2. Tether prints USDT without dollars.

Issuance is only possible after fiat funds are received into the company’s reserves. Every dollar credited to the account corresponds to an equivalent amount of tokens in circulation. This mechanism makes USDT issuance transparent and controlled. Verification is provided by independent Tether BDO audits.

Myth 3. TRON is a “cheap” network.

Transfers did used to cost less, but the situation has changed. Today the standard USDT TRC-20 fee without energy rental is 6.77–13.37 TRX. At an exchange rate of about $0.3, this is equivalent to 2–4 dollars. To cut expenses, users increasingly use TRON energy rental and infrastructure services such as Tron Pool Energy.

Myth 4. USDT can be frozen.

Yes, such a possibility exists, but it is applied only under AML and sanctions-compliance requirements. Freezes affect only addresses associated with illegal activity. Ordinary users are not at risk, and the control system maintains the ecosystem’s security.

These facts confirm that Tether operates in accordance with international transparency standards. Regular checks and open reporting strengthen confidence in the token and reinforce its reputation in the market.

Tether regularly faces criticism, but it is more often related to trust than liquidity. The company increases transparency by publishing Tether’s proof of reserves and detailed reports on asset structure. This helps users verify that the backing fully covers the circulating supply of tokens.

To mitigate risks, an independent Tether BDO audit is carried out, where specialists confirm the quality and allocation of assets. According to the latest reserves report, about 70 percent of funds are placed in short-term U.S. Treasuries, making the backing resilient and liquid.

In Europe, the MiCA regulation is coming into force, governing the issuance and reporting of stablecoins. At the same time, the TRON network remains outside sanctions restrictions, so USDT is freely used in international settlements and within the TRON DeFi ecosystem.

The issuance and backing of Tether USDT are under strict control and confirmed by independent audits. The company publishes Tether’s proof of reserves in open access so that users can verify the token’s transparency and robustness. This reporting system makes USDT a reliable instrument for storage and payments in the digital economy.

The TRON USDT network has become the main venue for circulation and DeFi operations. It provides high confirmation speed and predictable fees, which is important for everyday transfers. The Tron Pool Energy solution helps users reduce the cost of sending USDT, making TRC-20 usage both cost-effective and safe.

Together, these elements form a resilient TRON DeFi ecosystem based on speed, stability, and efficiency.

USDT is issued by Tether Limited, part of the international iFinex group. Each token is backed by reserves in dollars, Treasuries, and other reliable assets, as confirmed by independent audits.

The company’s reserves are reviewed by auditor BDO Italia, and the results are published publicly in the form of Tether’s proof of reserves. This guarantees that the volume of assets fully covers the number of minted tokens.

All data are available on the Tether Transparency Report page, which shows reports, reserve structure, and issuance volumes. A user can independently verify balances and the history of token mints.

The TRON USDT network processes millions of transactions per day and is supported by all major exchanges. Thanks to stable infrastructure and predictable fees, it has become the primary venue for stablecoin circulation.

Without TRON energy (the blockchain’s internal resource), the transfer fee is about 6.77–13.37 TRX. When connected via Tron Pool Energy, the transfer cost drops to 3–6 TRX, and with an Unlimited connection you can avoid buying TRX altogether.

These are resources analogous to gas on Ethereum, enabling transaction execution and smart-contract operation on the TRON network. Through Tron Pool Energy, a user can provision energy in advance and save on transfers.

Simply activate Unlimited energy via Tron Pool Energy, after which the system automatically maintains a balance of 131,000 Energy and 600 Bandwidth — sufficient for any USDT transfer. This allows sending tokens without purchasing TRX and without additional fees.