Technical Analysis: How to Identify Market Signals and Build a Strategy

Learn the basics of crypto technical analysis: charts, levels, indicators, and entry points. Understand the market and act without emotions.

2025-11-10

Authorization is required only to use the service «Team energy»

Enter the e-mail you provided during registration and we will send you instructions on how to reset your password.

An error occurred while processing your request. Please try again later. If the problem persists, please contact our support team.

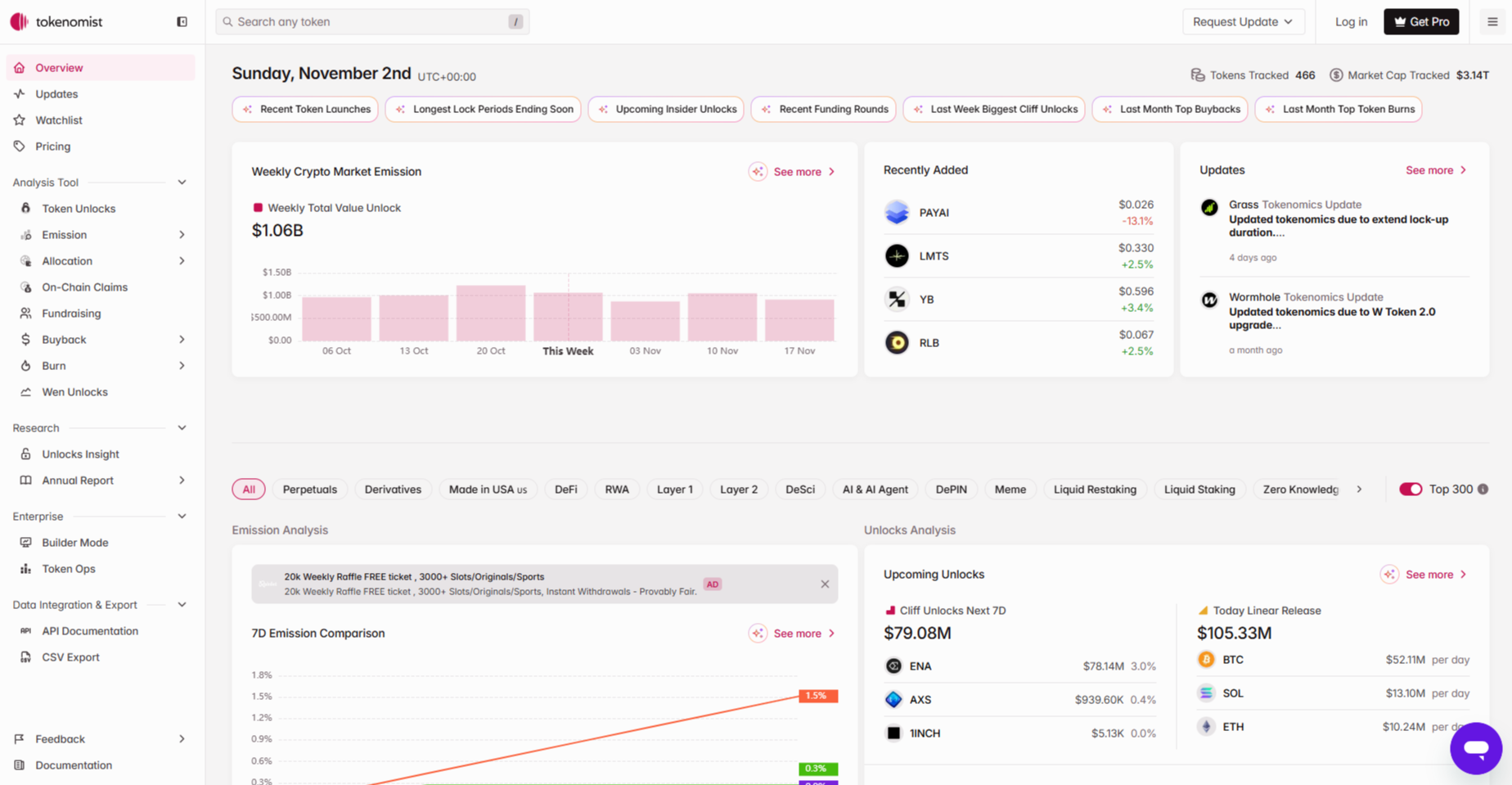

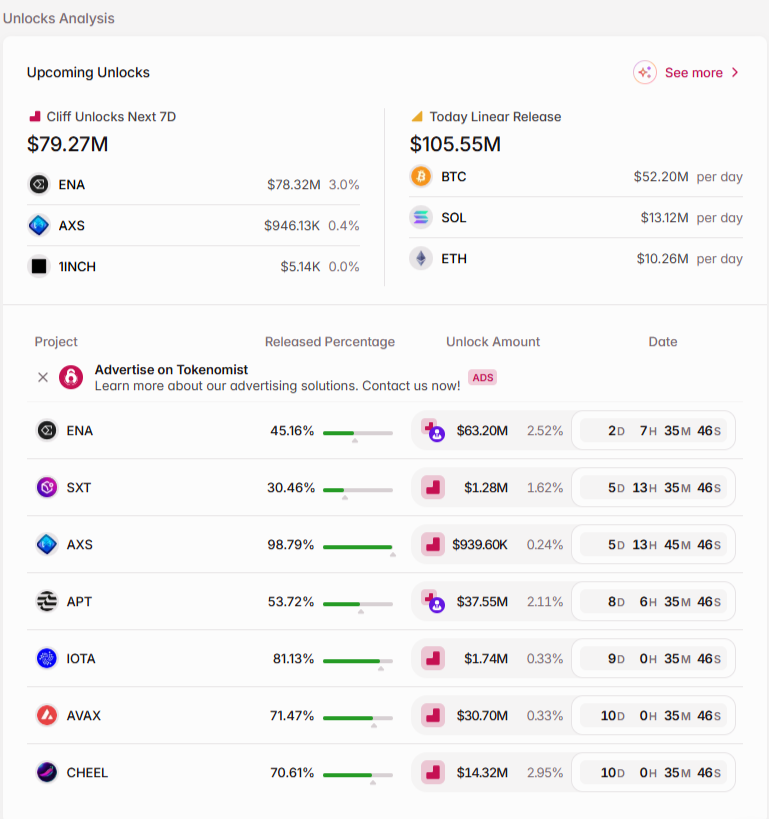

Tokenomist.ai — the updated TokenUnlocks. A breakdown of how to track upcoming unlock events, read vesting charts, and understand their impact on price.

In most crypto projects, only a small portion of tokens circulate freely. The remaining coins stay with the team, investors, and funds; they become available gradually according to a pre-set schedule. When the time comes for the next token unlock, a large volume hits the market, which can noticeably affect the price. Many users still search for a token unlocks calendar, although after the 2024 rebrand the service received a new name — Tokenomist.ai, and the up-to-date calendar is now hosted on this site.

What you will find in this article

Once you understand how Tokenomist.ai works, it becomes much easier to spot hidden project risks and make more informed decisions. You will get a detailed token unlocks app guide tailored to the updated Tokenomist.ai interface.

In the world of crypto projects, the phrase token vesting means the gradual release of accrued coins to those who participated in the project from the very beginning — the team, investors, and funds. Instead of releasing the entire supply into free circulation immediately after listing, the project sets a period of lock-up and gradual distribution. This approach reduces the risk of sharp sell-offs and price crashes. It shows that the team believes in the project’s long-term development and helps strengthen community trust.

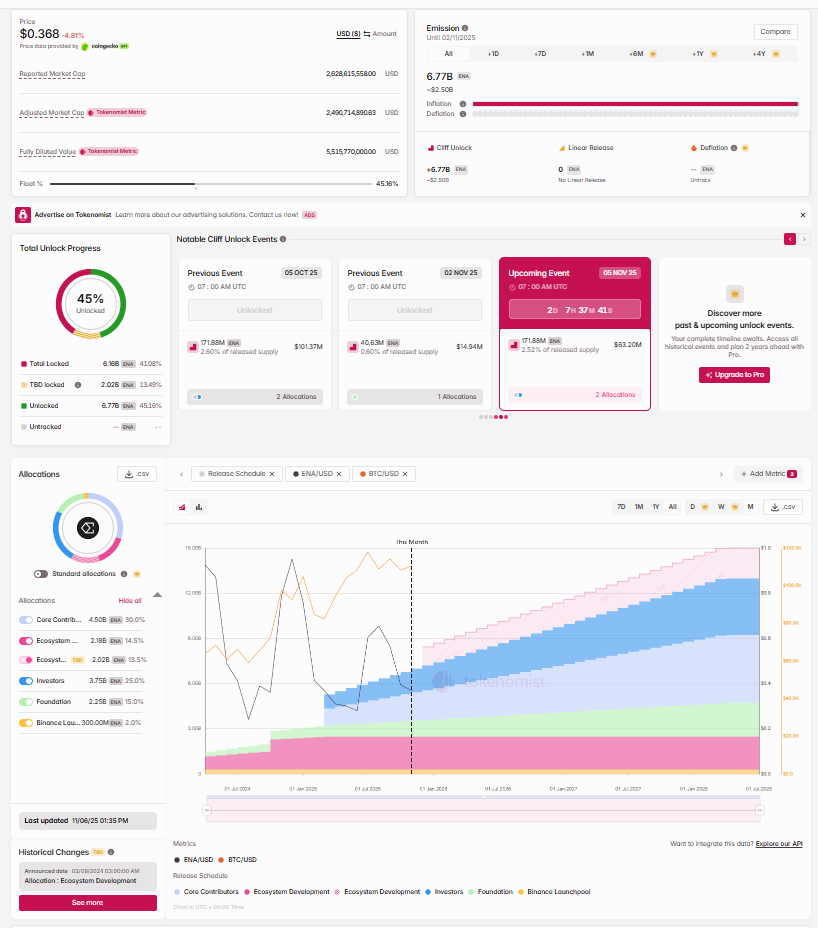

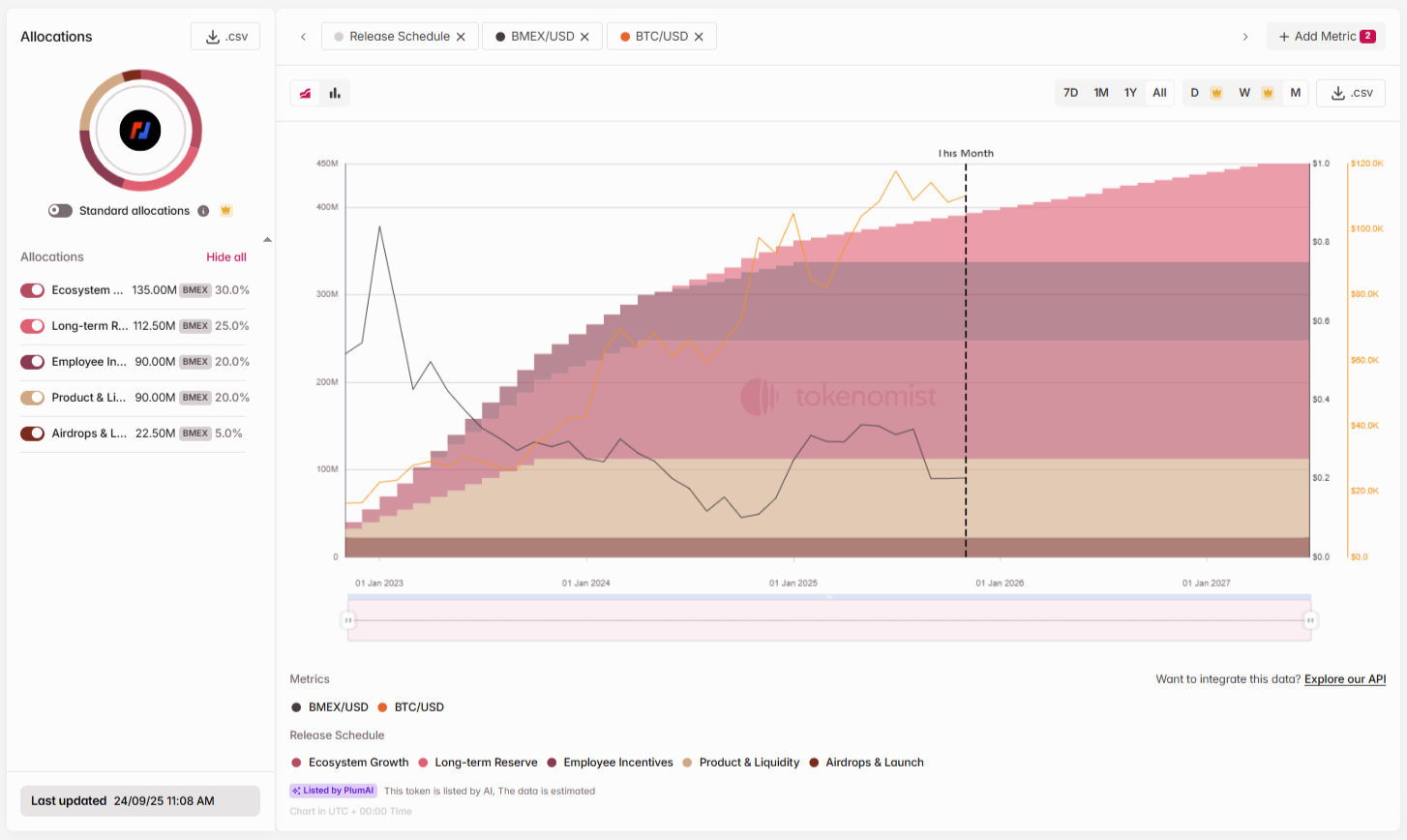

When you see a token vesting distribution, it’s important to understand what components it consists of:

Understanding what cliff linear unlock is helps you correctly evaluate the token’s economics and predict market behavior. Without such analysis, you may miss periods when the risk of increasing supply and price pressure becomes especially high.

After the rebrand, the Tokenomist.ai platform became more visual and functional.

Here is a simple step-by-step breakdown of how to open the site, understand the interface, and find the needed asset:

Pay attention to several important metrics that will help you better understand the token’s information:

Clicking an event on the chart or in the table lets you see how many tokens (as a percentage and in dollars) will be unlocked on a specific day.

Just looking at numbers is one thing; understanding what’s behind them is quite another. If you open the token vesting chart on Tokenomist.ai, you can see which unlock periods are associated with increased risks and why prices most often change at those moments.

What matters to analyze:

This is what the process of reading tokenomics unlock looks like. You see who receives tokens, on what dates, and in what volume, after which you can assess how these events will affect liquidity and potential price fluctuations.

On Tokenomist.ai there are dedicated sections where you can view both future and already completed token unlocks. This data helps forecast market behavior and analyze how it reacted to similar events in the past.

The Tokenomist.ai homepage displays a general list of upcoming token unlocks. Here you can use filters to choose the network of interest, date range, or unlock volume. This format replaces the conventional calendar and allows you to quickly find the necessary events right from the main screen.

The Post Unlocks Analysis section shows real examples of unlocks that have already occurred. It’s an excellent base to take a token unlocks example and see how the market reacted. If the token’s price had already declined during the previous unlock, this can be considered a warning. The next event may trigger a similar market reaction, so it is worth factoring in this risk in advance.

Unlocking assets is not limited to simple statistics; it can significantly impact a project’s development. When coins come out of lock-up and enter circulation, the total amount on the market grows, and if demand does not increase, the price usually starts to fall.

Here’s how it works:

If a tight area is visible in the token distribution, for example a large unlock for investors scheduled to occur in one or two weeks, this should be considered a potential price-correction risk.

The information provided by Tokenomist.ai is a useful tool for the fundamental analysis of crypto projects. It complements common indicators such as market cap, trading volume, and total value locked, helping to form a more complete picture of a project’s condition.

Use it as follows:

Over time, the unlock calendar (crypto unlock calendar) stops being just a list of dates and becomes a convenient way to understand how events affect the market.

Some users are interested in whether Tokenomist.ai has data on TRON network tokens or USDT TRC-20 stablecoins. At the time of writing, TRON network projects (JST, SUN, WIN) did not appear in Tokenomist.ai search.

Since stablecoins (USDT/USDC) do not have vesting, they are also not included in the unlock calendar. Their issuance and burning depend on demand, not on a vesting program. The platform focuses primarily on assets with transparent distribution and vesting schedules — mainly projects operating on Ethereum, BNB Chain, Arbitrum, and other popular ecosystems.

Therefore, if you are looking for token unlocks tron or trying to find a jst sun unlock schedule, you should consider that such data is absent on Tokenomist.ai. At the time the article was written, the service did not track unlocks of assets related to TRON.

Tokenomist.ai, previously known as TokenUnlocks, is considered one of the most accurate and convenient platforms for analyzing token unlocks today. However, there are several other tools that can complement your research and provide a broader view of the market. Each has its own features, interface, and level of data detail.

If your main goal is to find a reliable token unlocks calendar, the best option is to use Tokenomist.ai. The platform is specifically designed for vesting analysis, so it provides highly accurate charts, up-to-date dates, and clear visualizations. It focuses specifically on tokenomics rather than external events, making it the primary tool for those who study crypto unlock calendars in a professional format.

Tokenomist.ai helps analyze a project’s tokenomics and understand how tokens are distributed among participants. The service shows when and how many coins will enter circulation, who will receive them, and how this may affect the market. If you combine Tokenomist.ai data with information from CoinMarketCap, DeFiLlama, and other analytical platforms, you can get a complete picture of token flows and make decisions with greater confidence.

If you use Tokenomist.ai, pay attention to the main dashboard. It displays all upcoming token unlocks, and this data helps you understand which events may influence the market in the near future.

Vesting is a pre-defined schedule under which a project’s tokens become available to its team, early investors, and funds. It is needed so that these participants cannot sell all their tokens immediately after launch and crash the price. The Tokenomist.ai service allows you to track this process.

The calendar on Tokenomist.ai helps investors see in advance the moments when a new volume of coins may enter the market en masse. This creates a risk of “sell pressure” and price declines. Tracking the calendar is an important part of risk management.

Unlocks increase the circulating supply of tokens, which, with unchanged demand, may lead to a price decrease. Even if the project is strong, the additional volume can create pressure. Tokenomist.ai makes it possible to see the date and size of such an event.

Cliff is a period when token unlocks are not yet occurring. Linear Unlock is the even distribution of assets after the cliff ends. On Tokenomist.ai you can see both phases on the Vesting Schedule chart.

The Circulating Supply metric is shown on each token’s page in Tokenomist.ai and indicates how many tokens are already for sale/in users’ hands, as opposed to Total Supply (total issuance).

At the moment, none of the popular analytics services shows unlocks for tokens related to the TRON network. Platforms such as Tokenomist.ai, CryptoRank, DeFiLlama, Messari, and VestLab do not include vesting data for TRX or internal assets like JST, SUN, or WIN.

No. Stablecoins like USDT do not have unlock schedules, and the Tokenomist.ai service tracks only tokens with a configured vesting schedule.